The Tapestry – Capri Acquisition Case, Part 1: Working Capital in M&A

This case is for the exclusive use of Professor Walter Clements with clients and students’ in his courses at the University of Notre Dame. The case, an acquisition offer by Tapestry Inc. to Capri Holdings Ltd. shareholders in 2023, includes numerical data from yahoo finance and 10k report filings with the SEC, and information from press releases by Tapestry, Capri and the U.S. Federal Trade Commission. Value opportunities described in this case are the views of its author and his students.

Case Objective

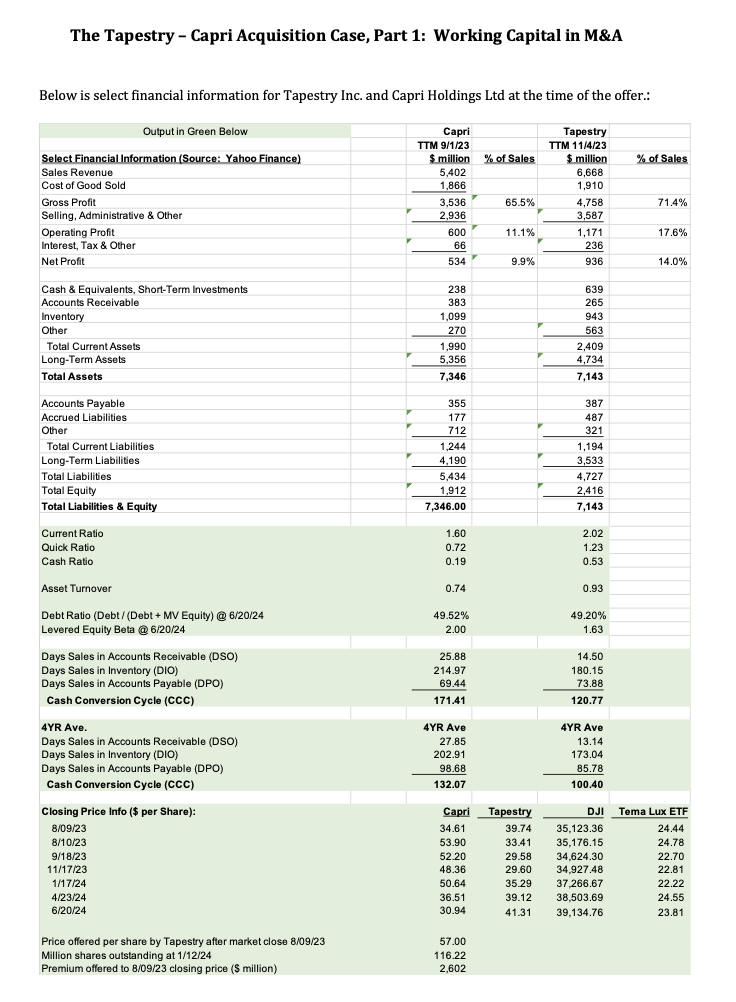

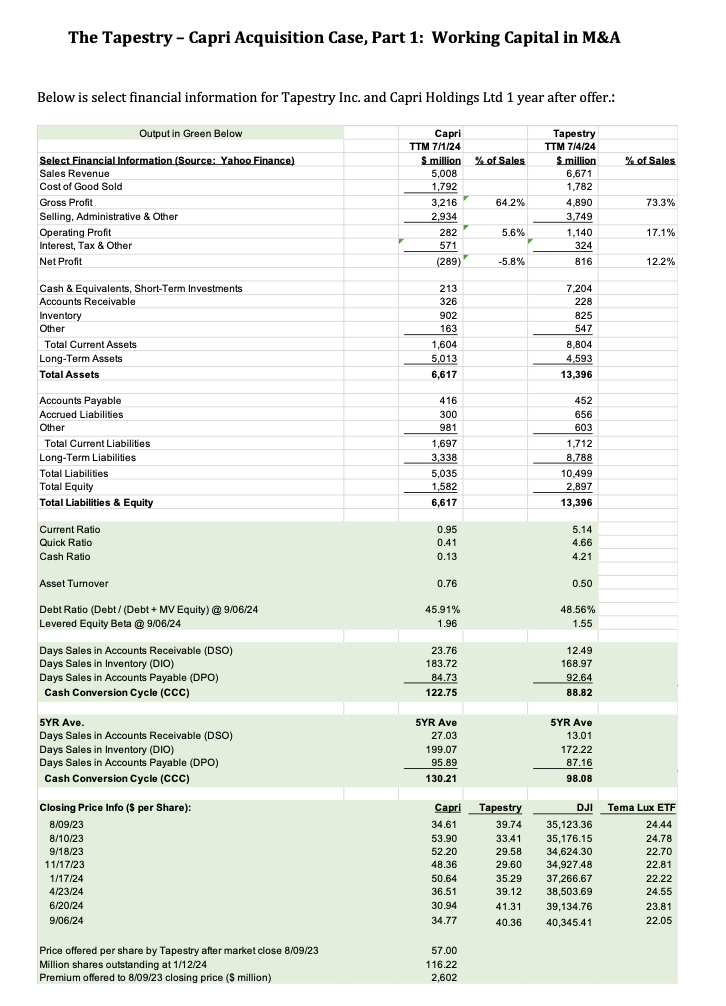

Assume you are advising Tapestry Inc. (NYSE ticker: TPR) about acquiring Capri Holdings Limited (NYSE ticker: CPRI) on the opportunities to create value and earn a substantial return. These include the traditional sources of value in private equity plays, including the annual $200 million run rate of cost synergies quoted in the press release on August 10, 2023. In this case, we set out to estimate other value creation opportunities, starting with Part 1 to estimate what might be available by improving the combined Tapestry – Capri working capital performance. In a separate Case, “Part 2”, we will evaluate the impact of reducing the risk profile of Capri’s cash flows and returns, and of increasing debt financing relative to equity.

Review and evaluate the working capital efficiency benchmark data for Capri and Tapestry shown below and estimate the value of improving working capital performance to the better performer between Tapestry and Capri.

Also include in your estimate, the benefit of inventory carrying cost savings that can be achieved with lower inventory levels (assume annual costs for holding inventory are between 20% and 40% of the value of inventory for things such as warehousing, freight, accounting, taxes, insurance, shrink, and obsolescence).

Assume Tapestry’s cost of capital is 12% and tax rate is 18% to estimate the value creation opportunity.

Prof. Clements and his students estimated a prize of $0.6 to $0.9 billion if Capri’s working capital and supply chain performance can be improved to equal Tapestry’s. Tapestry’s offer to Capri shareholders is a $2.5 billion premium. In this case, we explore what drives this estimate, and consider other important factors, such as:

1) The validity for using Tapestry’s working capital metrics as a target for improving Capri’s performance (vs. wider industry benchmarks, differences between Capri and Tapestry businesses, etc.).

2) The concept of considering inventory carrying cost savings per above.

3) The steps Tapestry would need to take to achieve these targets.

4) Appropriateness of considering working capital improvements in private equity plays, and how to treat in negotiations.

Background

August 9th after the market closed, Tapestry made an offer of $57 per share to acquire Capri. Capri’s closing stock price August 9th was $34.61 per share, making the $57 offer a 59% premium, or roughly $2.5 billion. The transaction was subject to regulatory review and expected to close early 2024. The press release by Capri on August 10th gives more details (link provided below).

Capri’s stock price rose to $54.50 when the market opened on August 10th, fluctuated between this level and $45 per share through early April 2024, then fell to the mid-$30 per share range, falling to $30.94 per share on June 20, 2024.

https://www.capriholdings.com/news-releases/news-releases- details/2023/Tapestry-Inc.-Announces-Definitive-Agreement-to-Acquire-Capri- Holdings-Limited-Establishing-a-Powerful-Global-House-of-Iconic-Luxury-and- Fashion-Brands/default.aspx

April 22, 2024, the U.S. Federal Trade Commission (FTC) brought legal action to prevent the acquisition by Tapestry, deeming it would reduce competition, especially in the accessible luxury handbag market, thereby adversely affecting customers, consumers, and employees. The preliminary injunction hearing to resolve this matter is scheduled to begin September 9, 2024.

https://www.ftc.gov/news-events/news/press-releases/2024/04/ftc-moves- block-tapestrys-acquisition-capri

Prof. Walter Clements Mendoza College of Business June 24, 2024